One option is to contribute a cash windfall, such as your tax refund or annual work bonus.

You may decide to round up by several hundred dollars if you have sufficient disposable income.Ī single payment is suitable when you have limited funds or are saving up your discretionary income for other financial priorities. For instance, instead of making a $1,062 monthly payment, you can contribute $1,100. Consider rounding up your payment amount to the next $100. For example, with a monthly obligation of $1,500, you’ll contribute an extra $125 each month, which is 1/12 of your standard payment. With this strategy, you’ll make an extra monthly payment over a year by dividing your principal and interest payment by 12. This tactic can also challenge you to consistently reduce your non-mortgage expenses.

Increasing your extra payment amount by $1 each month, meaning $1,000 in the first month, $1,001 in month two, $1,002 in month three and so on can be an affordable strategy for tackling your mortgage. You can always increase or decrease the amount later to match your budget. Consider starting small with $50 or $100. Contributing an additional fixed amount every month-or at any interval you can comfortably afford-can help you get out of debt sooner. Here are a few monthly repayment strategies you can try: Setting up extra recurring payments on a regular cycle can help you pay off your mortgage early. This way you can pay extra every month or make a larger payment every year to get the same benefits. If you find yourself in this situation, consider setting aside the appropriate funds in your banking account and continuing the standard monthly payment. Some mortgage servicers prohibit biweekly payments, and some charge fees to adjust your payment agreement. This totals out to 26 half payments per year-or 13 monthly payments-versus 12 monthly payments using the default repayment schedule.įor example, if you choose to make biweekly payments of $500 instead of the standard $1,000 monthly payment, you’ll end up paying $13,000 every 12 months instead of $12,000.

BIWEEKLY EXTRA PAYMENT MORTGAGE CALCULATOR FULL

In some months, you’ll only pay the equivalent of a full monthly payment but make an extra half payment during longer months. Instead of making a full monthly payment, you make half payments every two weeks. Biweekly mortgage payments are budget-friendly and make the equivalent of an extra monthly payment each year without significantly increasing your out-of-pocket costs. Biweekly Mortgage PaymentsĪ single monthly payment for the life of the loan is the default repayment frequency for most borrowers. Any additional payments you make are more effective when they’re applied earlier in the repayment term when your monthly interest charges are higher. The best option depends on how much extra you’re willing to put toward the loan and how quickly you want to pay off your home loan. There are multiple repayment strategies for owning your home outright sooner. Be sure to check with your lender to verify there are no prepayment penalties. This is the amount you’ll apply to your loan principal. Decide how much your extra payment amount will be. You can increase your extra payment amount or frequency as your finances improve. Decide between making monthly contributions or a single lump sum payment. This is different from your annual percentage rate (APR), which includes additional loan expenses, like mortgage insurance and discount points. List your current mortgage interest rate. The most common mortgage terms are 15 years and 30 years. Enter the number of years of your purchase loan.

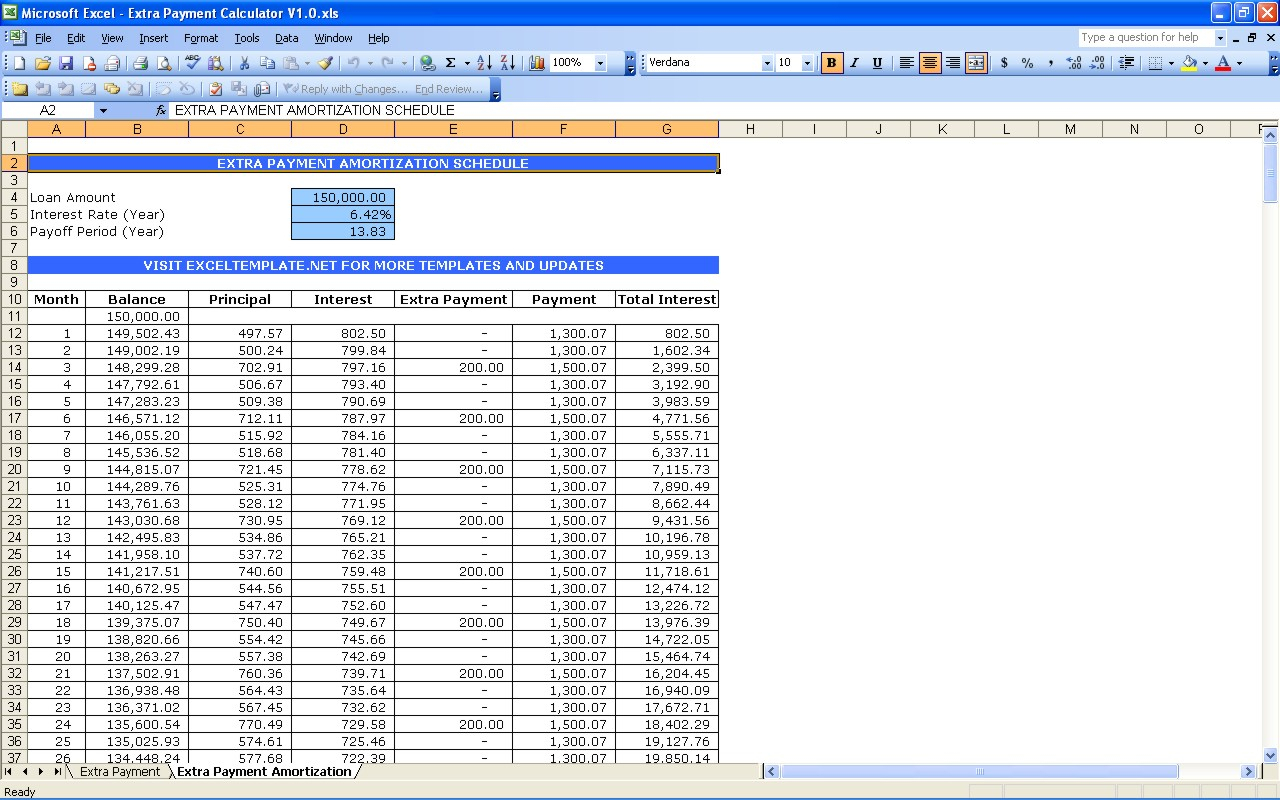

If you’re refinancing or already making repayments, include your minimum monthly mortgage payment, excluding taxes and insurance. Monthly interest and principal payments.If you’re refinancing or already making repayments, list the outstanding mortgage principal that needs to be repaid. This calculator won’t factor in private mortgage insurance or similar premiums. With a purchase loan, input your down payment amount as a percentage. If you have a purchase loan, input the price you paid for the home. Choose “refinance” if you’re getting a mortgage refinance or keeping your current loan. Choose “purchase” if you plan on buying a home and making extra payments immediately.

BIWEEKLY EXTRA PAYMENT MORTGAGE CALCULATOR HOW TO

How To Use the Additional Payment Calculatorīelow is a detailed summary of how to enter the appropriate loan information for a new or existing mortgage:

0 kommentar(er)

0 kommentar(er)